To calculate your Equated Monthly Instalments (EMIs) for repayment of your loan amount whether it is a personal loan, a vehicle loan, or a home loan, an interest rate calculator is a highly useful financial instrument that is necessary for all types of borrowers. Calculating the precise amount you must repay is an essential financial task because Equated Monthly Instalments, or EMIs, include both the principal and the interest payable and as a result using an interest rate calculator will result in better management of your personal finance. The loan interest rate is decided by various factors such as your credit history, income, loan amount, job profile whether self-employed or salaried and so on. When you apply for a loan, the responsible lender makes you clear about the interest rate payable across the chosen tenure. Using an interest rate calculator is thus beneficial as it takes a minute to calculate or determine your debts online.

Benefits of using an interest rate calculator

If you are going to use an interest rate calculator, here are the benefits that you need to be aware of:

- An EMI Calculator, often known as an interest rate calculator, aids in the determination of loan payments, or EMIs, for your loan. It is a simple calculator that serves as a personal finance tool for borrowers.

- An EMI calculator or interest calculator provides an excellent knowledge of the amount that must be paid as EMIs and assists in making an accurate conclusion regarding the personal finance expenditure.

- An interest rate calculator minimizes your time to know the exact monthly repayment amount. As a result of this, using an interest loan calculator always assists you in staying ahead of your personal financial position.

- An interest rate calculator provides you with a trustworthy tool that allows you to keep track of your due debts.

- Because loans have longer repayment terms, determining their repayment condition can be challenging. This is why you should look for an interest rate calculator to make it your personal finance partner.

How to use an online interest rate calculator?

Personal loan, gold loan, car loan, home loan, and other types of loans all have predetermined repayment terms with monthly payments defined as EMIs (equated monthly instalments) that must be repaid within the chosen tenure. An interest rate calculator, often known as an EMI calculator, is a tool that assists you in calculating your loan EMI depending on significant factors including the amount borrowed, the relevant interest rate, and the loan’s term. No matter where you are, you can use an online interest rate calculator anytime and anywhere that allows you to determine your budget-friendly EMI payments. When you search for an EMI calculator or interest rate calculator on Google, you will be provided with a variety of websites that offer an online interest rate tool. However, it is recommended that you use your lender’s EMI calculator since it is more user-friendly and displays the prevailing interest rate with accurate results. Simply enter the loan amount, interest rate, and loan term, and the tabulated figure will be revealed instantaneously. So, amid the ongoing COVID-19 pandemic and its lockdown, it will be better to use an interest rate calculator online from the comfort of your home to determine your budget-friendly monthly repayment amounts.

How to calculate loan EMI amount?

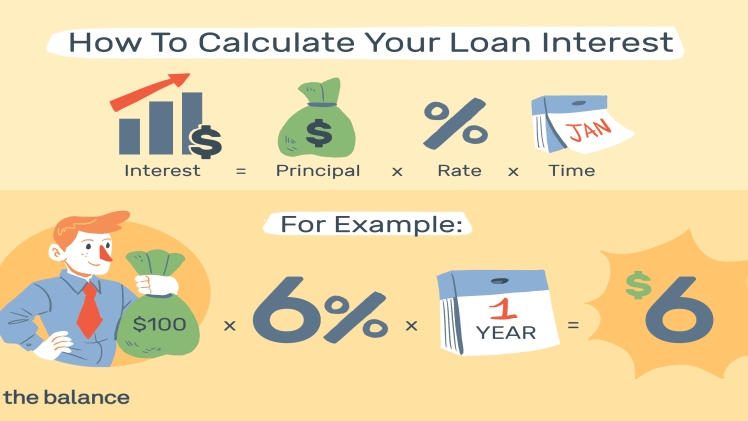

In case you don’t have an active internet connection, you can simply use the below-framed formula to calculate your interest rate and monthly EMIs.

E = P * r * (1+r)^n / ((1+r)^n-1)

In the above formula:

E is the EMI or Equated Monthly Installments

P is the principal loan amount

R is the rate of interest determined on a monthly basis

N is the tenure of the loan in months

The above method can be used to calculate all forms of loan EMIs. Alternatively, you may use an Excel sheet to compute your personal loan EMI using the MS-Excel formula “PMT.” The full code formula for EMI calculation in Excel is as follows:

PMT (rate, nper, pv)

In the above equation:

Rate is the prevailing interest rate in %

Nper is the loan tenure in the number of months

Pv is the principal loan amount

It is suggested to use an online interest rate calculator and avoid the above offline or manual calculation method. The online approach will not only show you the exact figure but also save your valuable time. Just by entering the required details, you will get the exact payable EMI just in a matter of seconds, which may result in time-consuming if you go with the manual calculation method.

Conclusion

The above-discussed formula both online and offline works on loans availed from all types of lenders. Interest rates on loans swing due to a variety of variables, spanning from Repo rate drops to inflation rates. As a result of this, using an online EMI calculator will allow you to get the exact figures instantly based on the prevailing interest rate. Apart from the interest rate of a loan, there are several other factors to consider while applying for a loan, such as the principal loan amount, tenure, relevant charges, lender’s terms and conditions, and so on. So by keeping all these factors in mind, you can easily apply for a loan and its resulting repayment amount can be determined by using an online EMI or interest rate calculator.